To make taxpayers' everyday lives easier and to reduce the administrative burden, the SRS provides a modern solution, EDS API, which is a service interface ("Application Programming Interface"). The EDS API enables data exchange on a "System to System" basis. This means that data stored or created in the taxpayer's system is sent online to the State Revenue Service (SRS) EDS database.

Submitting Your VAT Return without Leaving Odoo

The Midis Odoo team implemented the integration with the SRS EDS database, meaning an additional feature has been added to the Odoo localized accounting module. One of the main benefits of using Odoo is the ability to work with real-time data. For convenience and faster completion of work tasks, the system offers document processing, and one of the advanced features it provides is the ability to read information from scanned documents and automatically fill it into the system.

Required Configurations for a Successful Connection to the EDS Database

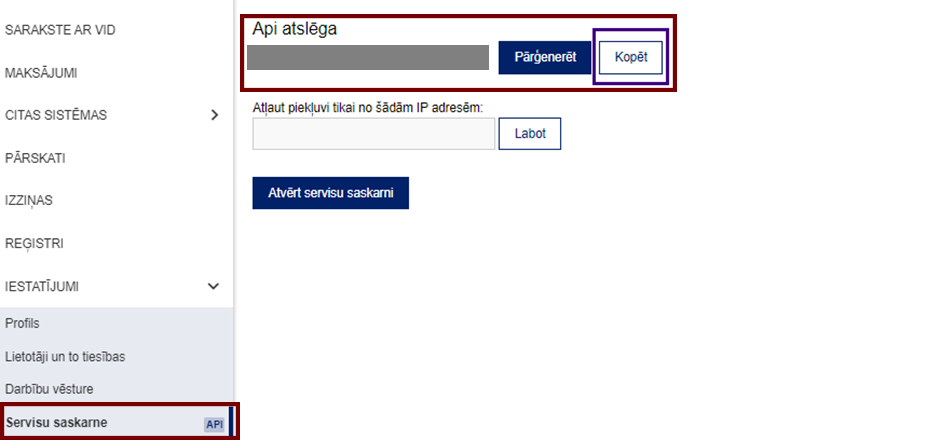

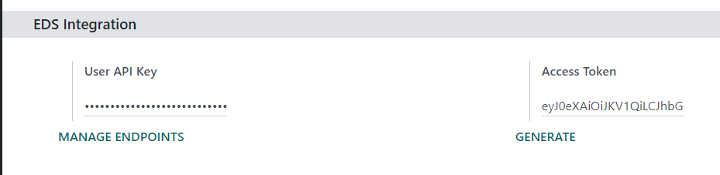

To be able to use the EDS API, you need to connect to the EDS system, check the permission to use the service interface, and generate an API key, which should be added later in the Odoo settings.

Next, add the generated API key in Odoo settings.

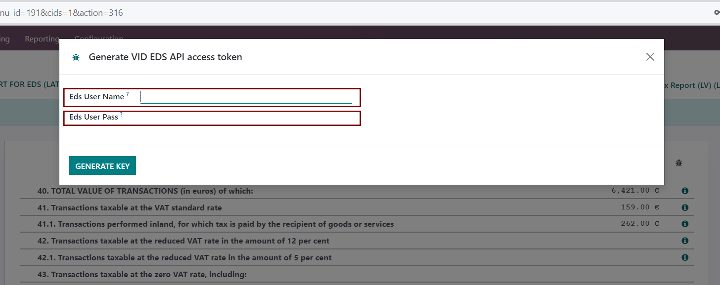

When submitting a VAT return, you need to enter the EDS username and password.