Do you know what is happening with your company's fixed assets right now? It is a good question because each asset has its own value. Managing the depreciation of assets in financial terms helps to balance costs and benefits from investment opportunities. It is essential to follow this calculation. Suppose such functionality is available on the balance sheet. In that case, it will help to better track the asset's residual value and, if necessary, make an informed decision to purchase a new investment.

Odoo ERP system's "Accounting" module provides such functionality. When a new asset is created, depreciation is written off each year at the end of the fiscal year, and all this is automatic and appears on the balance sheet. Below we will look at a detailed example with pictures of how it can be organized in the Odoo ERP system.

Fixed asset creation in Odoo accounting module

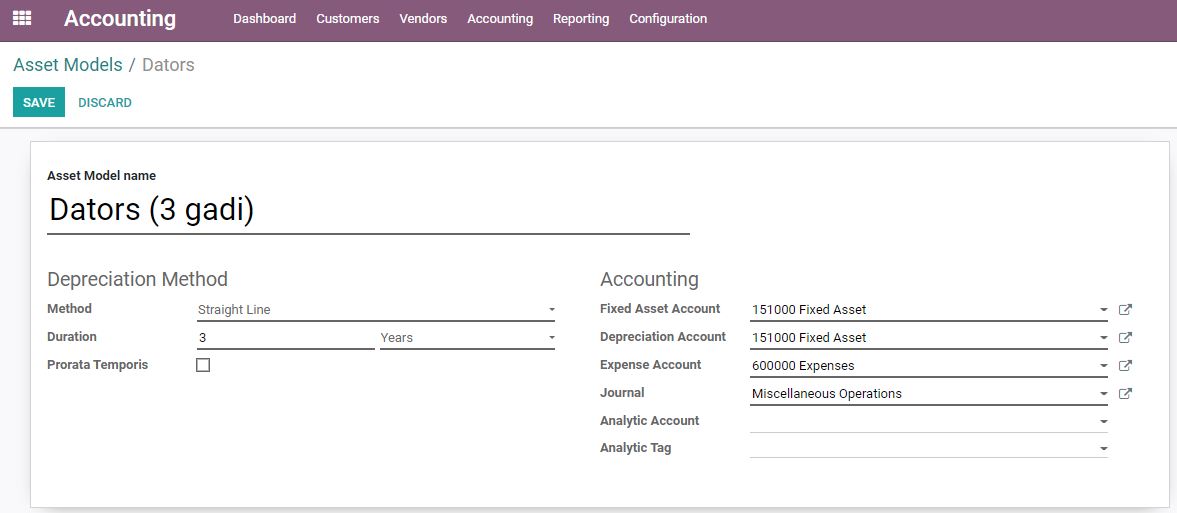

Let's start with creating an asset model. In Odoo version 14, it is possible to create asset models and assets. The asset model is an option for managing asset records and can create multiple assets with similar settings. The depreciation method, duration, asset account, etc., must be specified when creating the model. We save and continue.

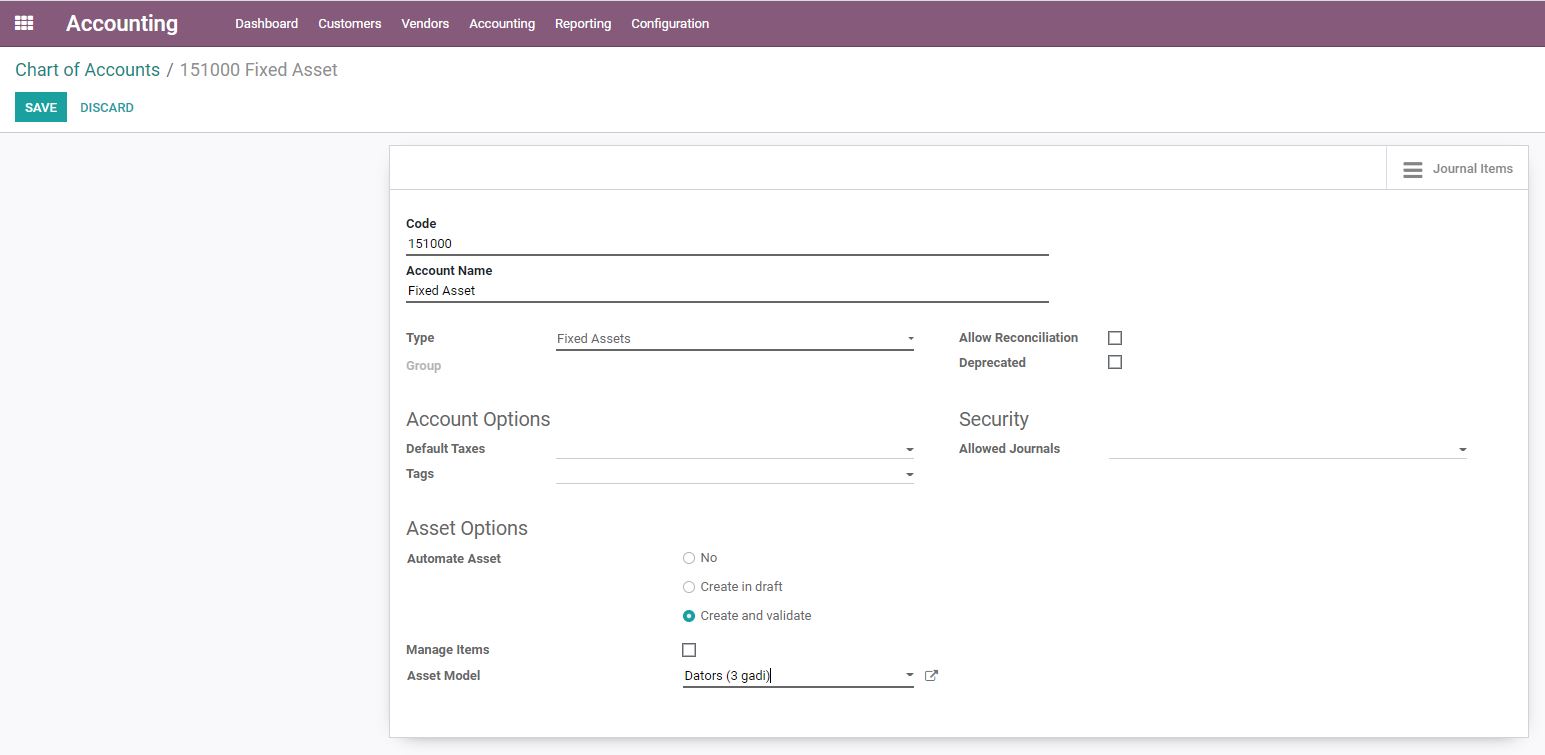

We continue by connecting the created asset model with the specified accounting account "151000 Fixed Asset". To do this, go to the account, and on the card next to "Asset Options," select "Create and validate," a new line will appear in which we add the created asset model.

Fixed asset purchase

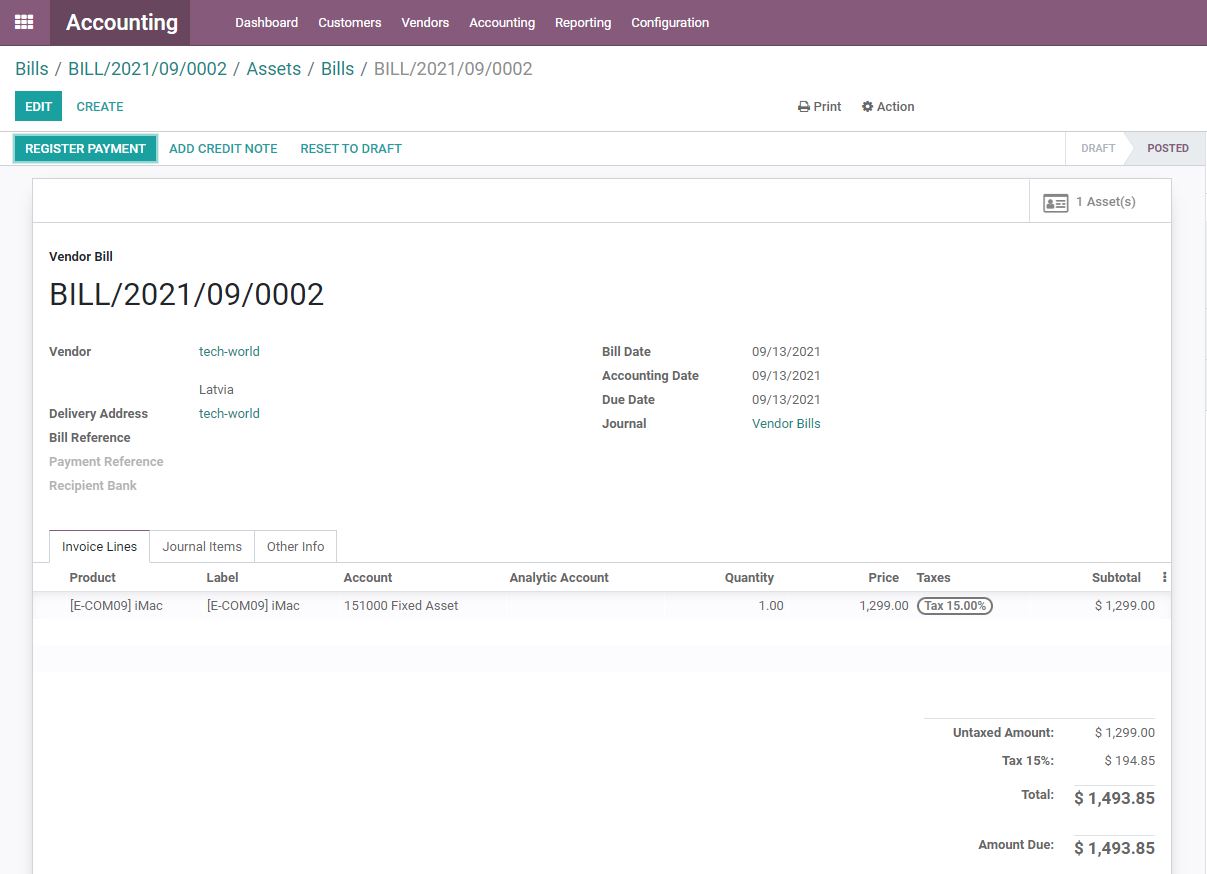

We made the necessary preparations, time to buy an asset. We will create a purchase in the accounting module. Select "Vendors," then "Bills," and press the "Create" button.

When creating a purchase, we specify an account, in this example, "151000 Fixed Asset", which we previously selected in the asset module. When you save and confirm this purchase, a new "1 Asset (s)" tab will appear for this card.

Depreciation schedule

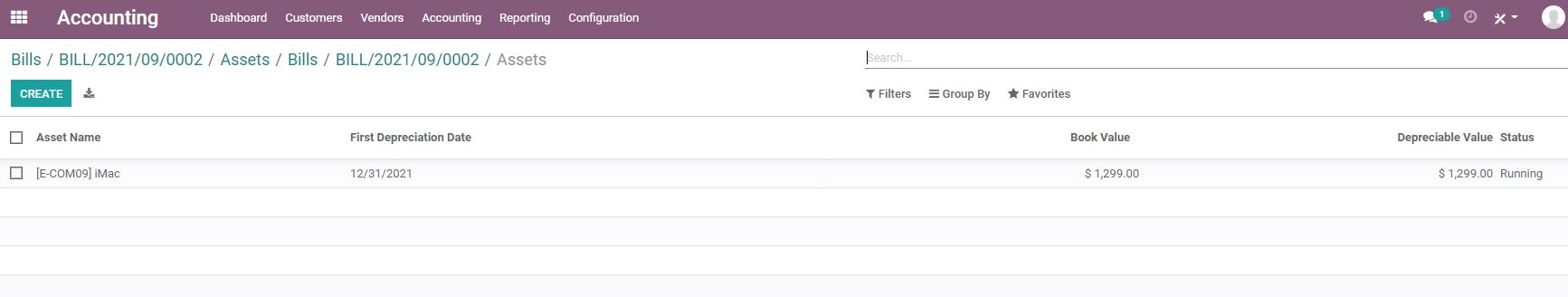

In the purchase invoice created there, where a new tab "1 Asset (s)" appeared, we will click and see the list of assets.

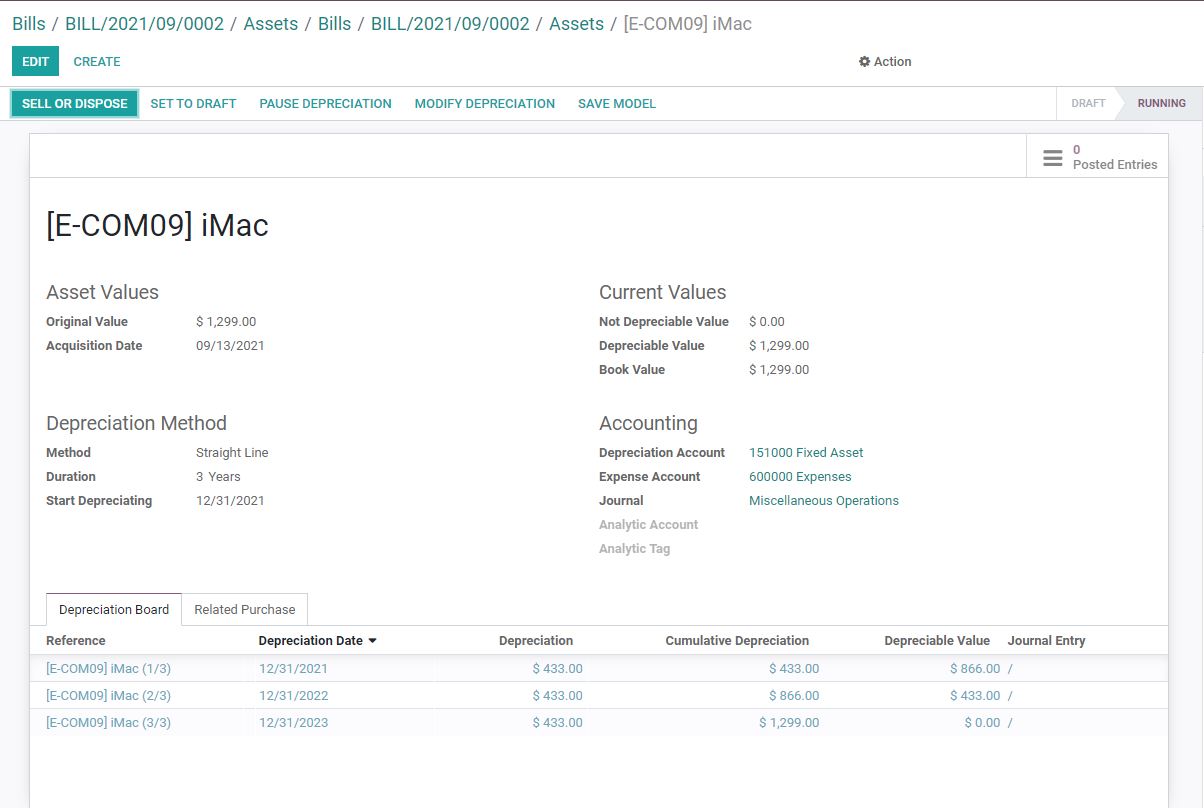

To view the depreciation schedule, click on the entry.

From this window, we can sell the asset, get rid of it, and so on. Below is all the information - asset value, acquisition date, current value, method, and account - in which this entry is located. At the bottom of the card, the schedule and the amount of the depreciation are shown, regarding when it will be written off. This amount was automatically calculated because we specified the straight-line depreciation method in the asset model over three years.

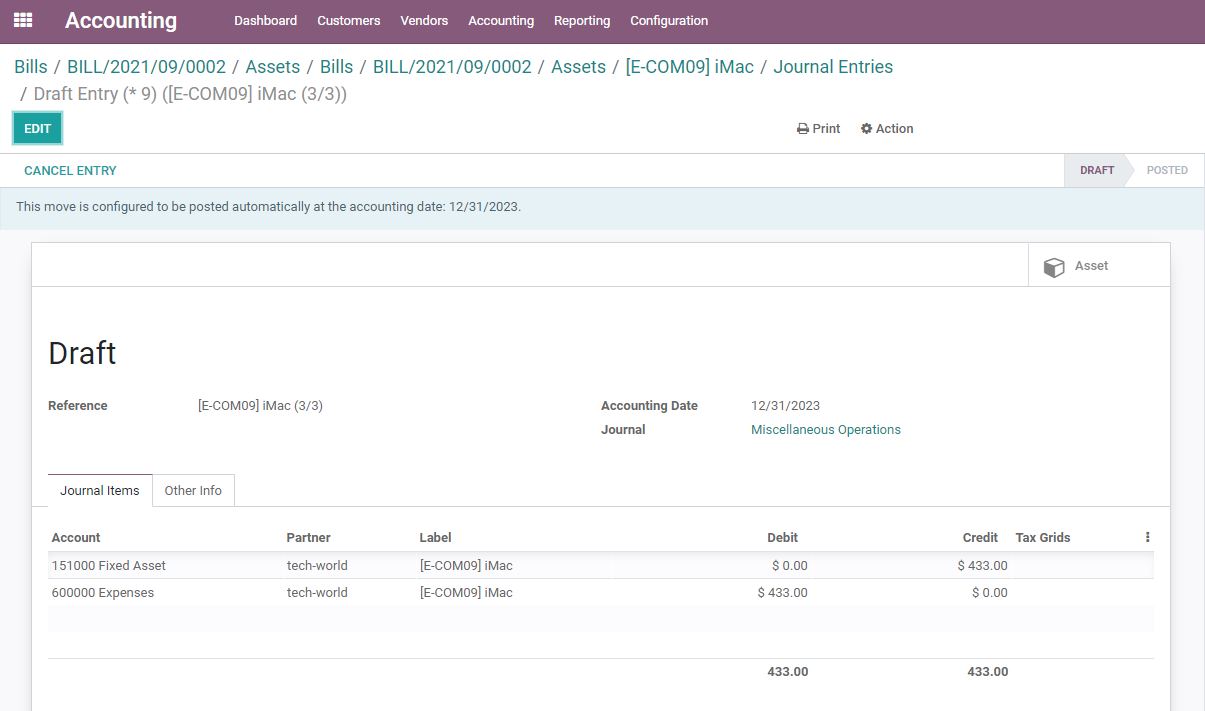

Clicking on any schedule entry takes you to the next window, where we see that the action is configured to run automatically on the accounting date.

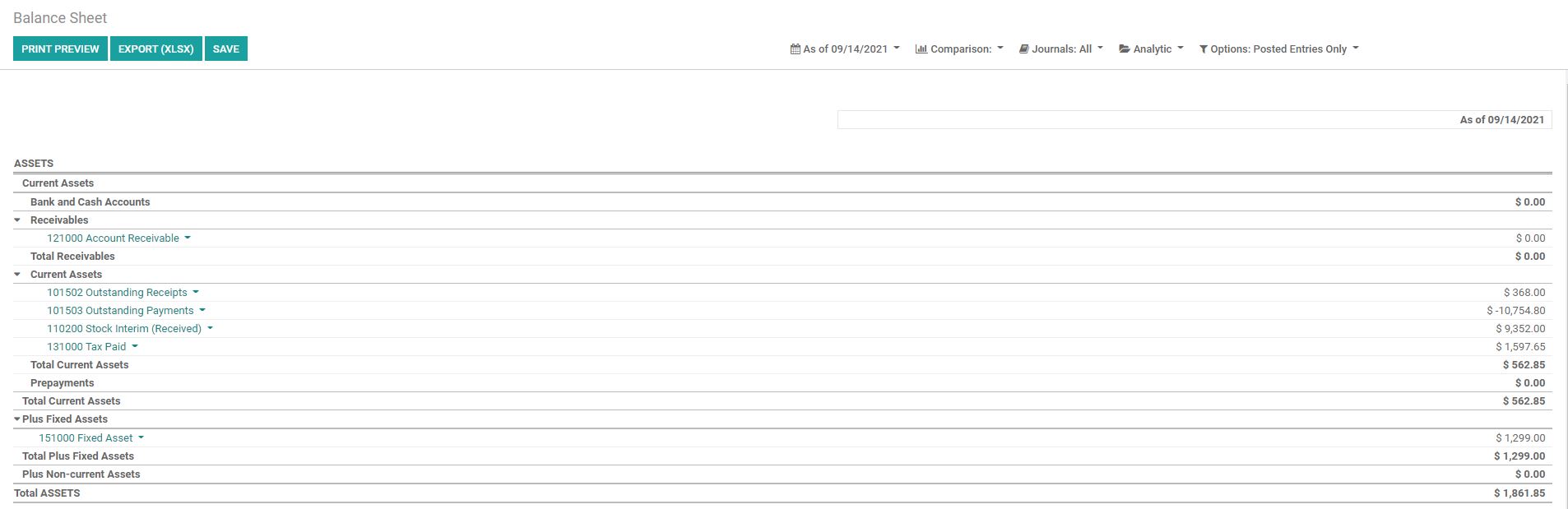

Balance sheet: The reflection of fixed asset purchase

The reports allow us to understand the current situation better. We see what amounts are being spent, await debtors, we owe creditors, and finances within the company. We have purchased an asset, and this entry immediately appears on the balance sheet.

On the list below in the entry "Fixed Assets", we see the total value of the newly created asset. On the balance sheet, we can see all of the company's financial activities, purchases, sales, etc.

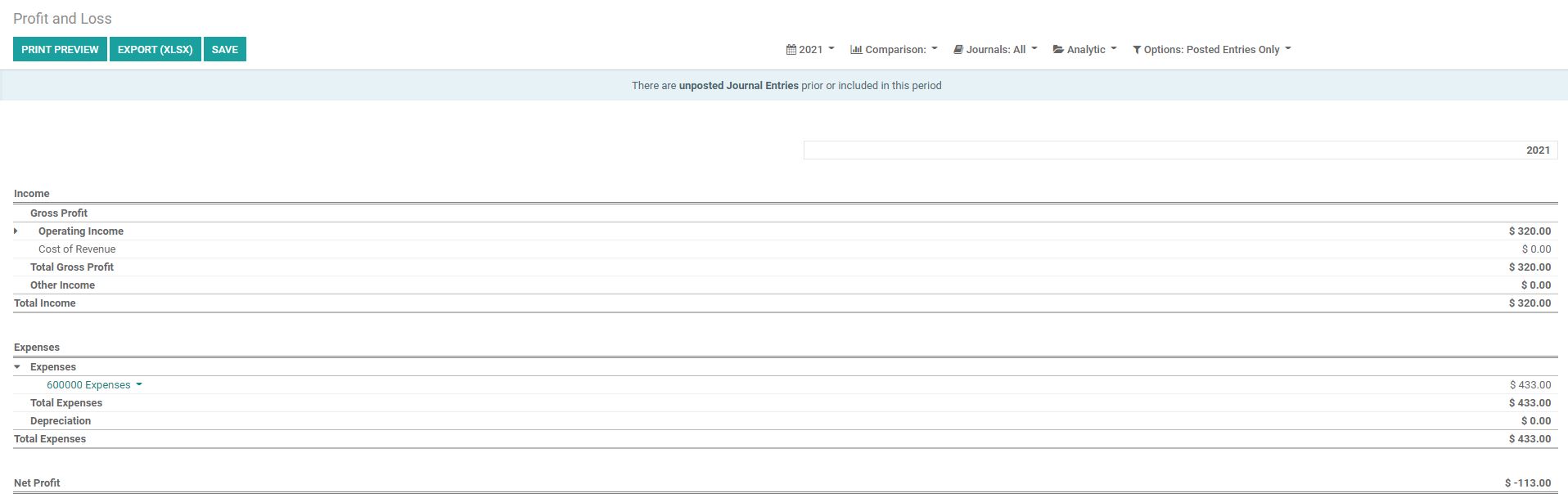

Profit and loss statement: Execution of fixed asset depreciation

When the schedule falls due, the amount of the asset's depreciation is written off. We can immediately see this amount in the income statement, which appears under the item "Expenses."

All of this is simple, and the main thing is that accounting with Odoo becomes understandable for the business manager. You can access financial key metrics anytime and anywhere!